When it comes to safeguarding your health and financial stability, few decisions are as impactful as selecting the right protection for your future. The modern healthcare landscape is evolving quickly, and individuals and businesses alike are seeking clarity on how to make well-informed choices. Planning for wellbeing isn’t just about reacting to illness—it’s about creating a framework that supports longevity, financial resilience, and peace of mind.

The Rising Importance of Health Planning

Across the globe, healthcare costs are climbing, and access to timely treatment often comes down to preparation. For individuals, this preparation can mean the difference between receiving quick specialist care and waiting months in a public healthcare queue. For businesses, it can translate into healthier employees, reduced absenteeism, and greater productivity. In both cases, strategic planning empowers people to focus on recovery instead of financial strain.

Balancing Needs with Options

The sheer variety of available health-related plans can be overwhelming. Some offer broad coverage, while others specialize in niche areas such as dental, maternity, or long-term care. The key lies in assessing personal or organizational priorities. For instance, younger individuals might prioritize affordability and basic coverage, while families often value comprehensive benefits that include children’s health. Businesses may focus on packages that enhance employee satisfaction and retention.

Preventive Care as a Cornerstone

Preventive care is gaining prominence as one of the most cost-effective approaches to long-term health. Screenings, vaccinations, and regular check-ups are increasingly covered in modern plans, shifting the focus away from crisis management toward early detection and wellness maintenance. This proactive stance reduces costs in the long run and ensures that small issues don’t escalate into major health concerns.

The Role of Digital Tools

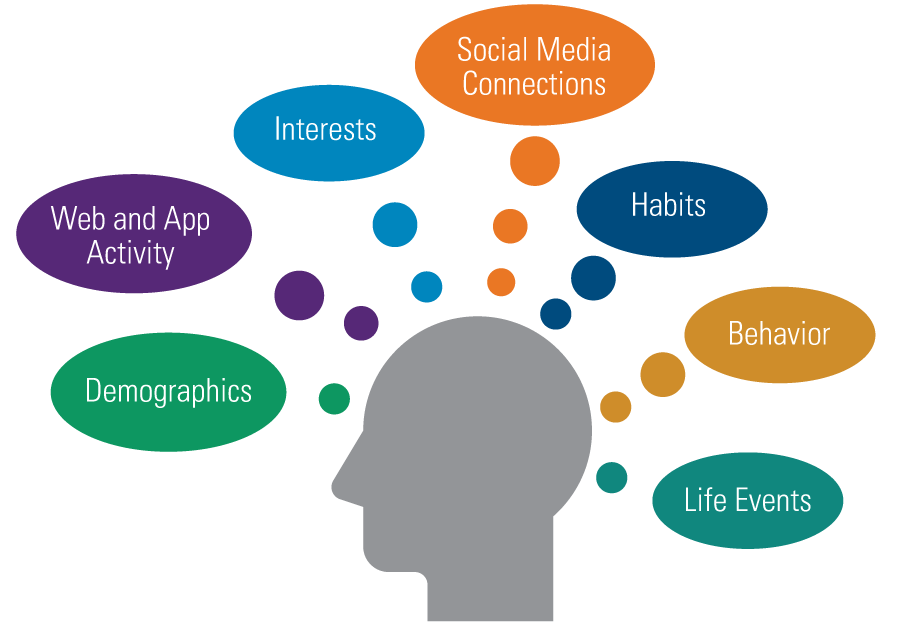

Technology is transforming how people engage with healthcare services. From telemedicine consultations to AI-driven health assessments, digital tools provide convenient and efficient ways to stay on top of personal wellbeing. Many providers now integrate apps that allow policyholders to track appointments, monitor prescriptions, and even receive wellness reminders. For businesses, such tools enhance accessibility and reduce administrative overhead.

Navigating Complexity with Guidance

For many people, understanding the nuances of policies is daunting. This is where expert advice and carefully researched resources come into play. A comprehensive guide to health insurance helps individuals cut through jargon, compare plan features, and make choices aligned with their needs. Such resources are invaluable, especially for those encountering health planning for the first time or considering switching providers.

Financial Protection and Peace of Mind

One of the primary reasons individuals and businesses invest in health planning is financial security. Unexpected illnesses or accidents can lead to overwhelming costs. With proper coverage, these risks are mitigated, allowing people to focus on recovery rather than bills. For businesses, offering comprehensive employee health support can also improve reputation and foster loyalty.

Global Trends Influencing Choices

Global health trends are influencing how providers structure their offerings. Aging populations, mental health awareness, and chronic disease management are now shaping policies. Plans that once overlooked mental health services are now incorporating therapy sessions, while others are focusing on tailored support for conditions like diabetes or cardiovascular disease. These changes reflect a broader understanding of holistic wellbeing.

The Future of Health Planning

Looking ahead, the focus will likely continue to shift toward personalization. Just as digital marketing tailors ads to individual preferences, healthcare plans are beginning to offer customizable modules. This ensures that people aren’t paying for unnecessary extras while still receiving robust coverage in the areas that matter most. It’s a shift toward fairness, flexibility, and customer empowerment.

Conclusion

Smart choices in health planning aren’t about chasing the cheapest option—they’re about aligning coverage with real-life priorities. Whether you’re an individual seeking protection or a business investing in your workforce, the right plan can safeguard wellbeing and finances simultaneously. By taking a proactive stance today, you’re investing not just in your present, but in a healthier, more secure future.